Multi for Omni

(R)evolution in banking.

Traditional client services in bank branches have in recent years been expanded to include new technologies as they have emerged. Banks have typically added new access channels to complement the traditional branch services thereby creating multichannel solutions in which channels have operated independently of each other, based on their own processes.

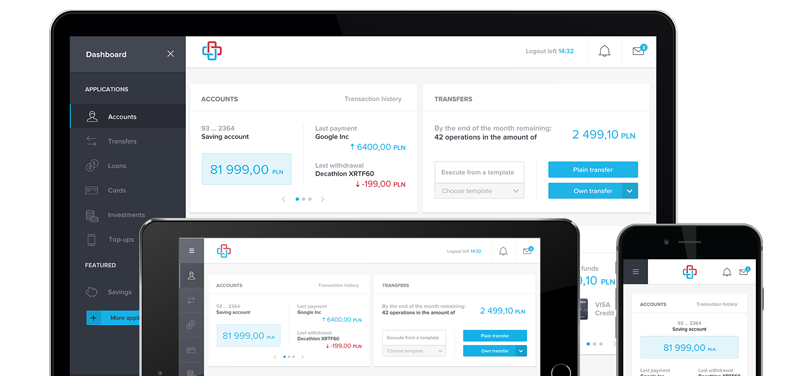

And while these alternative channels were of secondary importance to the client this tactical approach to building service was acceptable. But once the alternative channels turn into primary channels of client choice, then this multichannel strategy ceases to be satisfy the client’s needs. To meet current and future client expectations an environment needs to be built that ensures a uniform and consistent level of customer service - an omnichannel environment.